All Categories

Featured

Table of Contents

The rate is set by the insurance provider and can be anywhere from 25% to more than 100%. (The insurer can additionally alter the get involved rate over the life time of the plan.) If the gain is 6%, the involvement price is 50%, and the existing money worth total amount is $10,000, $300 is added to the money value (6% x 50% x $10,000 = $300).

There are a variety of benefits and drawbacks to take into consideration before purchasing an IUL policy.: Just like basic universal life insurance coverage, the insurance holder can boost their premiums or reduced them in times of hardship.: Quantities credited to the cash value grow tax-deferred. The cash money worth can pay the insurance coverage premiums, enabling the insurance policy holder to lower or stop making out-of-pocket costs repayments.

Several IUL plans have a later maturity date than other kinds of universal life plans, with some finishing when the insured reaches age 121 or even more. If the insured is still alive at that time, plans pay the survivor benefit (however not normally the cash worth) and the profits may be taxed.

: Smaller sized plan face worths do not supply much benefit over regular UL insurance policies.: If the index goes down, no passion is attributed to the money worth.

With IUL, the objective is to profit from higher activities in the index.: Due to the fact that the insurance policy business only gets alternatives in an index, you're not directly purchased supplies, so you do not profit when companies pay dividends to shareholders.: Insurers fee fees for managing your cash, which can drain cash value.

Universal Life Insurance Cash Value Withdrawal

For lots of people, no, IUL isn't better than a 401(k) in terms of conserving for retired life. Most IULs are best for high-net-worth individuals trying to find ways to decrease their taxable revenue or those who have actually maxed out their other retired life choices. For everyone else, a 401(k) is a much better investment lorry since it doesn't lug the high charges and costs of an IUL, plus there is no cap on the amount you may earn (unlike with an IUL policy).

While you might not lose any money in the account if the index decreases, you won't make rate of interest. If the market transforms bullish, the revenues on your IUL will certainly not be as high as a typical investment account. The high cost of premiums and fees makes IULs costly and significantly much less economical than term life.

Indexed global life (IUL) insurance policy uses cash money worth plus a fatality advantage. The cash in the money value account can gain interest through tracking an equity index, and with some typically assigned to a fixed-rate account. Indexed global life plans cap how much money you can accumulate (often at less than 100%) and they are based on a perhaps unstable equity index.

Equity Indexed Universal Life Insurance Policy

A 401(k) is a much better option for that purpose since it doesn't carry the high costs and costs of an IUL policy, plus there is no cap on the quantity you may gain when spent. Most IUL policies are best for high-net-worth people seeking to lower their taxable revenue. Investopedia does not provide tax obligation, investment, or monetary services and guidance.

An independent insurance coverage broker can compare all the options and do what's best for you. When contrasting IUL quotes from various insurer, it can be complicated and challenging to recognize which choice is best. An independent financial specialist can describe the different functions and recommend the ideal option for your distinct circumstance.

Eiul Policy

Instead of looking into all the different alternatives, calling insurance coverage companies, and asking for quotes, they do all the job for you. Many insurance representatives are able to conserve their customers money since they understand all the ins and outs of Indexed Universal Life strategies.

It's a reputable organization that was developed in 1857 HQ lies in Milwaukee, serving for years in monetary services One of the biggest insurance provider, with about 7.5% of the market share Has been serving its insurance policy holders for over 150 years. The company supplies 2 types of offers that are term and irreversible life plans.

For them, term life policies consist of persistent ailments, increased fatality benefits, and guaranteed reimbursement options. For a Mutual of Omaha life-indexed insurance plan, you require to have a quote or obtain in touch with a qualified representative.

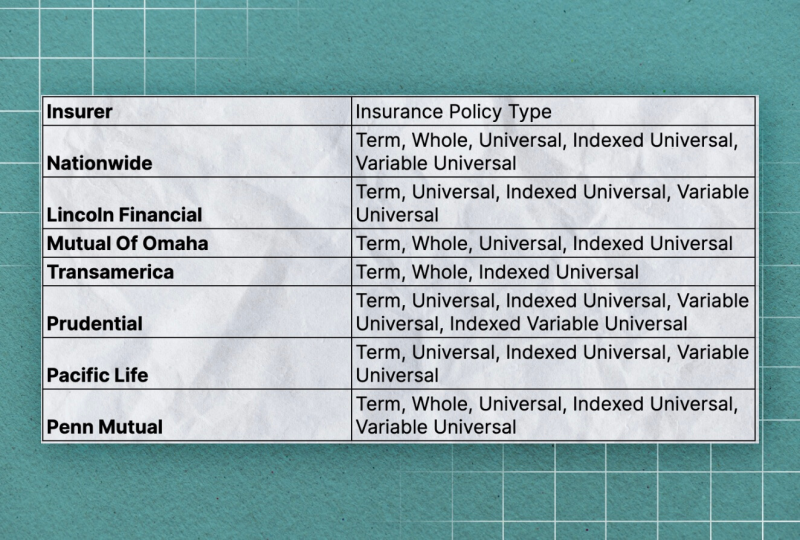

Penn Mutual provides life insurance coverage policies with numerous benefits that suit people's needs, like individuals's financial investment goals, economic markets, and budget plans. An additional organization that is renowned for supplying index universal life insurance coverage policies is Nationwide.

Universal Vs Whole Life Comparison

The headquarters of the business is located in Columbus, Ohio. The firm's insurance coverage plan's toughness is 10 to thirty years, in addition to the supplied coverage to age 95. Term plans of the business can be transformed right into long-term plans for age 65 and eco-friendly. The business's global life insurance coverage policies use tax-free survivor benefit, tax-deferred revenues, and the flexibility to change your premium settlements.

You can also use kids's term insurance policy protection and long-lasting care protection. If you are looking for one of the leading life insurance policy firms, Pacific Life is a fantastic choice. The company has regularly gotten on the leading checklist of top IUL firms for several years in terms of selling products given that the business created its really first indexed global life items.

What's good concerning Lincoln Financial compared to various other IUL insurance coverage firms is that you can additionally convert term policies to global plans given your age is not over 70. Principal Monetary insurer supplies services to around 17 countries across worldwide markets. The company gives term and global life insurance coverage policies in all 50 states.

Additionally, variable global life insurance policy can be considered for those still searching for a much better choice. The cash value of an Indexed Universal Life policy can be accessed through plan car loans or withdrawals. Withdrawals will certainly decrease the death benefit, and financings will certainly accumulate interest, which must be paid back to keep the plan effective.

Universal Life Insurance Expires When

This policy design is for the consumer who requires life insurance however wish to have the ability to choose just how their money value is invested. Variable policies are underwritten by National Life and distributed by Equity Solutions, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Company, One National Life Drive, Montpelier, Vermont 05604.

The information and descriptions consisted of right here are not meant to be full descriptions of all terms, conditions and exclusions applicable to the product or services. The exact insurance policy protection under any kind of COUNTRY Investors insurance policy item undergoes the terms, problems and exemptions in the real plans as released. Products and services defined in this internet site vary from state to state and not all products, insurance coverages or services are available in all states.

This details sales brochure is not a contract of insurance policy. The plan discussed in this information pamphlet are secured under the Policy Owners' Protection Scheme which is administered by the Singapore Down Payment Insurance Firm (SDIC).

To find out more on the kinds of benefits that are covered under the system as well as the restrictions of coverage, where suitable, please contact us or see the Life insurance policy Association, Singapore or SDIC web sites () or (www.sdic.org.sg). This ad has actually not been assessed by the Monetary Authority of Singapore.

Table of Contents

Latest Posts

Books On Indexed Universal Life

Insurance Stock Index

Ul Accounts

More

Latest Posts

Books On Indexed Universal Life

Insurance Stock Index

Ul Accounts